In investments, trust is an essential element. “Without trust – said Rachel Botsman, Trust Fellow at Oxford University – we would not be able to manage or invest our money”. Unfortunately, this factor does not only depend on one’s own abilities but can be influenced by a multitude of factors, including external ones.

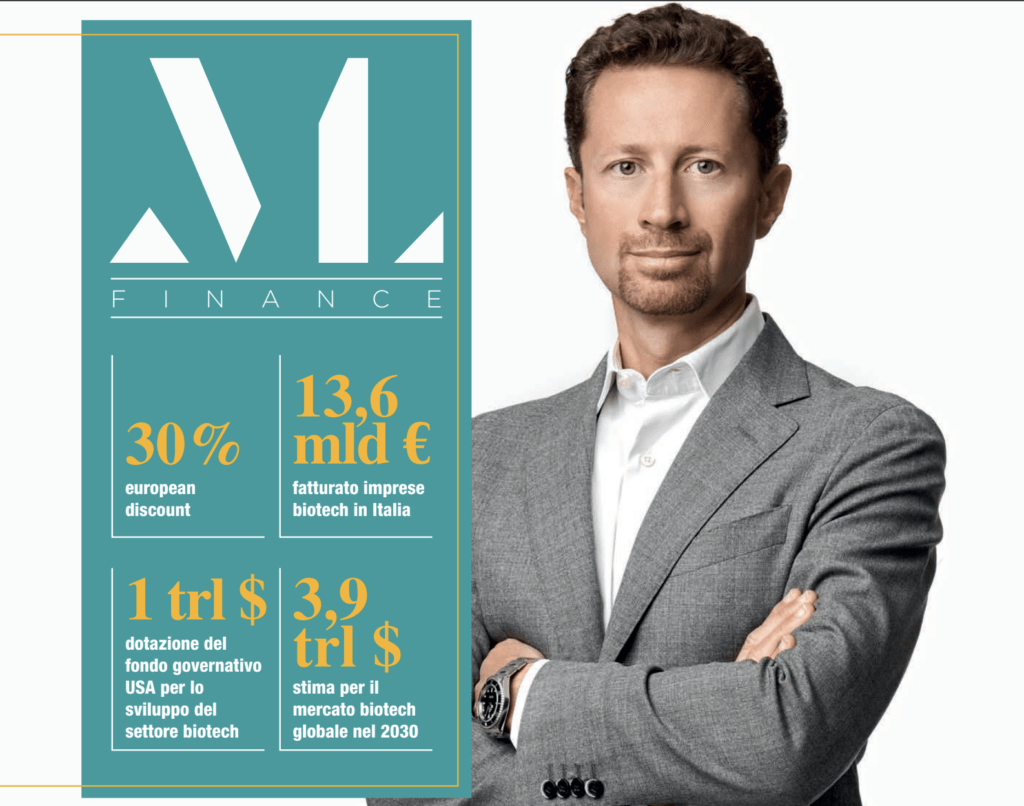

In the world of finance it is a very clear concept: during the 2011-12 economic crisis, investment fund managers were actively hunting for securities traded on the “European discount”, a reduction in valuation due to the fact that the company was based in Europe. The discount had no real economic basis, given that it was also applied to companies that carried out a large part of their activity outside the country of origin. Sanofi, for example, obtained only 5% of its profits in France but its price was, proportionately, 14% lower than its counterpart Johnson & Johnson. The weight of trust is even greater in the case of venture capital. According to research from Tilburg University, the level of trust in a nation positively predicts investment decisions of venture capital funds despite having a negative correlation with the success of investments (incidentally, Italy was the worst in terms of trust among the countries considered, behind Greece and Portugal). Furthermore, research suggests that investing at earlier stages requires a greater level of trust. If we add to this picture that Italy ranks 38th out of 54 countries in the ranking of innovation in the biotechnological field (behind Poland and Hungary), we understand the difficulties our biotech companies may encounter when they enter the international market to look for investments.

This working table presents an element of significant innovation for our country because it does not limit itself to bringing together political representatives but, drawing inspiration from the models of the American commissions, also includes important representatives of industry and research. In addition to me as moderator, several prominent figures will also participate, for example Giovanni Caforio, the CEO of Bristol-Myers Squibb who in 2019 led the acquisition of Celgene Corporation worth over 70 billion dollars. He is one of the most successful Italian managers in the United States and his experience is fundamental for bridging with overseas and international realities. Then there are Pierluigi Petrone of Farmindustria with the group of the same name, Gianmario Verona, of the Human Technopole, exponents of the CNR and the top management of ENEA Biomedica Tech. Obviously there is no shortage of representatives of ministries such as Maeci and Mimit (the Ministries of Foreign Affairs and that of Business and Made in Italy). The conditions are good and I expect that together we can carry out completely new work to make our biotech sector explode, which deserves it for its great quality and potential impact on patients.”

From a strategic point of view, what does the participation of its CEO at a table of this type mean for Genenta?

Within biotechnology, market dynamics are stratified globally. We could say that the United States represents the “series A” of the sector, followed by China as “series B” and Northern Europe (“series C”). In this context, Italy and southern Europe represent the “cadets”. The reception of investors is obviously different depending on where you come from: if a company has valid data and a solid scientific basis and is based in a nerve center like Boston-Cambridge, its path is downhill and it is welcomed with all the honors , find a lot of money and good ratings. If the same company comes from a “province of the empire”, such as Italy, its evaluation will be more difficult and the accreditation more cumbersome. Of course it doesn’t mean that the company has a lower value, but it will be welcomed with greater distrust. It’s completely natural. As an example, when Genenta was listed on the Nasdaq in 2021, it suffered what is called a “European discount” – a 30% discount in valuation compared to our American counterparts. Companies from Boston-Cambridge or Silicon Valley, on the other hand, obtain stellar valuations, sometimes even excessive, thanks to the hype that surrounds them. For the entire Italian biotech system, therefore, it is essential to change the perception towards our country and its companies. Being part of this Table means increasing visibility, having institutional relationships first level. In short, closing part of the gap just mentioned. That is, moving up a category.

Does the bilateral meeting between Italy and the United States which was held in November also fit into this context?

Of course, it is part of a process aimed at making our companies known to the financial world and the American government today and internationally tomorrow, generating the trust necessary to be able to dialogue with them on the same level. In the conference “Italy-USA: international cooperation on emerging biotechnologies and life sciences” we involved key figures for this path, people of the caliber of Stephen M. Hahn, manager director of Flagship Pioneering and former commissioner of the FDA during the pandemic, Renee Wegrzyn, director of ARPA-H, Charles Roberts of ARK Invest, right-hand man of Cathie Wood, Laura Tadvalkar of RA Capital. Joe Buccina of the National Security Commission on Emerging Biotechnology. It is clear that if you manage to establish a stable relationship with a network of this caliber, the nature of the dialogue with institutions and large international investors changes profoundly. In my opinion this is invaluable. For the entire Italian biotech ecosystem, not just for Genenta. It is essential that we all carry on this work together, it cannot be left aside to the single initiative. Also because there is no shortage of competition and there are a lot of other nations better organised. Our French cousins, for example, present themselves en masse at the JPMorgan Conference in San Francisco, thus having an extraordinary impact, supported by enormous public funds: they also organize numerous events, thus attracting much more attention to their companies. It’s crucial to get noticed, but if each company acts individually, the effect is minimal. Instead, by participating as part of an organized system, the possibilities of attracting capital, creating alliances and developing products significantly increase.

What does this process involve?

It is clear that we need to be recognized for our worth. Even if at a research level we may not be exactly at the level of Americans, our cost is definitely lower, about 40% less. Our value, however, is certainly not less than 40%. In fact, the quality/price ratio of our research is extremely advantageous. It is essential to communicate and explain this benefit. After all, investors are human beings, and as such they need to be able to trust the people and organizations they are investing in. It is necessary for them to see, know, visit, study, ask questions and reanalyze everything. Only after having built this trust can you proceed with an investment or collaboration. It’s a crucial step.

Where are we at?

To paraphrase a well-known phrase attributed to Kissinger: if America were to call biotech in Italy, who should it talk to? Here, we are trying to give an answer to this question, we are creating a system for those who want to turn to Italy in the biotech sector. Finally we have our ARPA-H, i.e. the ENEA Tech and Biomedical Foundation and our National Security Commission, i.e. the national table for the biotech transition. Now the caller has an interlocutor.

In the ATMP sector there is a serious problem of economic sustainability, at least for those involving rare or ultra-rare diseases. The Holostem case is the latest example.

The key question here, of course, is whether this action will lead to financial gain or not. I don’t know Holostem and therefore I can’t express an opinion on the merits, but it’s clear that there is a fundamental problem here. We must accept the idea that, in some way, therapies for rare, or super rare or super rare, monogenetic diseases were de facto a proof of concept of a technology. Let’s look at Strimvelis for example, which treats around 20 patients a year. From a scientific point of view it was undoubtedly a success, having also paved the way for Genenta or companies such as Altheia Science. However, from the point of view of economic sustainability these therapies are not fully sustainable because the number of patients is too limited. I am not informed about the specific situation of Holostem but even in that case, despite having great technologies and skills capable of creating very interesting know-how, the bet on the available market remains. Now cell therapy and gene therapy are entering phase 2, moving from rare genetic diseases to autoimmune and oncological ones, where the possibilities are enormous. It is clear that there is also an ethical aspect: even if there are few patients, their lives can be saved but we cannot imagine that it is the companies that bear this burden, in these cases public institutions should intervene.

What strategy does Genenta have?

Our strategy is “tumor agnostic”, meaning that we do not focus on a single type of tumor, but develop a product aimed more generally at solid tumors. We have already demonstrated the effectiveness of our product in this field starting with glioblastoma, a particularly aggressive and difficult to treat tumor. We chose this path for several reasons: there is a greater number of patients available, the immune system is functioning and there is a huge void on the market. Now that we have demonstrated the initial safety and biological activity of the product, it makes sense to extend the research to other tumor indications, such as renal cell carcinoma and bladder cancer. The product was designed from the beginning to be applicable as widely as possible, starting from a base that already covers a much larger number of patients and a market than that of rare diseases. A product approved on glioblastoma, for example, would be a blockbuster, capable of generating over a billion euros per year and improving the lives of many people.

What can be done to improve the sustainability of the sector?

One lesson from the pandemic has been that health authorities can take more action quickly in the product approval process. One of the fundamental themes of cell and gene therapies is that, even for established products, the production, release and testing required by authorities takes a long time. For example, while cell production may take only a few hours, the release process can take up to weeks. This happens because, despite the experience accumulated in hundreds of treatments, it is necessary to carry out numerous other tests which take time and increase costs. To make these therapies more accessible and reduce costs, we must aim for two goals main. First, manufacturing must become more industrialized and faster. Second, the regulatory and testing process by authorities should be simplified o accelerated. If we could reduce the release time from weeks to a few days, the cost of the drug could drop significantly making the treatment accessible to more patients. This is a real revolution that must happen both at an industrial level, in the process production, both at a regulatory level, in the simplification of procedures.