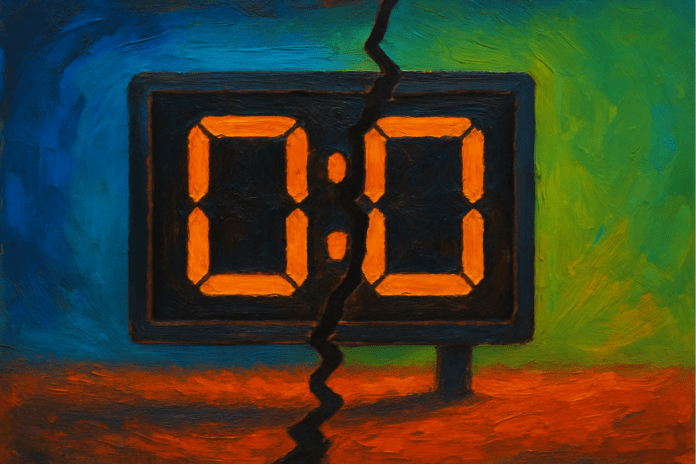

The Pharmaceutical Industry Enters a Critical Phase. Between 2025 and 2030, patents for more than 120 active ingredients are set to expire, according to an analysis by Evaluate reported in the Financial Times. The estimated value of sales generated by these drugs exceeds $180 billion — a staggering figure that is expected to shrink dramatically with the arrival of generics and biosimilars.

The so-called “patent cliff”, already observed in the previous decade, is now returning with greater scale and complexity. Pharmaceutical companies are not only facing the expiry of numerous blockbuster patents, but they must do so in a landscape shaped by regulatory pressures, international competition, and a global push to optimize healthcare spending.

Expiring blockbusters: names, dates, and numbers

Among the most significant drugs nearing patent expiry are true industry giants. Leading the list is Keytruda by Merck, a flagship monoclonal antibody in immuno-oncology. In 2023, the drug generated approximately $29.5 billion globally. Its U.S. patent protection is set to expire in 2028 (Merck, February 2025).

Another major drug approaching patent expiry is Eliquis (apixaban), an anticoagulant produced by Bristol Myers Squibb and Pfizer. Its U.S. patent is set to expire in April 2028, as confirmed by settlement agreements with generic manufacturers (BMS Investor Statement, 2024).

Humira (adalimumab), AbbVie’s blockbuster for autoimmune diseases, lost exclusivity in the U.S. at the beginning of 2023. That same year, global sales declined by approximately 32%, with a 45.3% drop in the U.S. market, according to AbbVie’s official 2023 financial report.

Other high-revenue drugs nearing the end of patent protection include:

- Ibrance (Pfizer), with extended exclusivity until March 5, 2027;

- Eylea (Regeneron and Bayer), expected to lose protection in the 2025–2026 timeframe in the U.S.;

- Xtandi (Pfizer and Astellas), with composition patents valid through 2027 in the U.S. and 2026 in Europe and Japan.

A harsher competitive landscape

In the 2000s, the first patent cliff triggered a wave of generics. Today, however, companies face an even more aggressive environment. The rise of biosimilars — enabled by streamlined regulations and technological advances — has intensified competition in the biologics space, once considered difficult to replicate.

Markets like China and India are accelerating local approvals and manufacturing, often backed by highly aggressive pricing strategies. This, in turn, is pushing Western healthcare systems to promote the use of equivalent products to contain public spending.

Big Pharma’s defensive strategies

Major pharmaceutical companies are mobilizing to avoid a collapse. Several strategic approaches are being deployed:

-

Mergers and acquisitions: Multibillion-dollar deals — such as Pfizer’s acquisition of Seagen — provide fast access to innovative pipelines.

-

Investments in artificial intelligence: AI is being leveraged to accelerate drug discovery, identify more promising targets, and reduce time-to-market.

-

Development of “bio-betters”: Improved versions of original drugs, designed to replace blockbusters before their patents expire.

-

Focus on rare diseases: Niches with less competition and greater regulatory tolerance for premium pricing.

In addition, companies are expanding into advanced therapeutic areas such as gene therapies, CAR-T, RNA-based treatments, and personalized approaches.

Regulatory pressure is mounting

In the United States, the introduction of the Inflation Reduction Act has enabled price negotiations for certain high-impact drugs, with mechanisms that may take effect even before patent expiry. This marks a significant shift, potentially prompting companies to revisit their pricing and market positioning strategies as early as the second half of the 2020s.

At the same time, public and political pressure is growing for more equitable access to medicines — a demand that has intensified since the pandemic. The traditional justification of high prices based on R&D costs is becoming less persuasive, especially when the system perceives a lack of genuine therapeutic innovation.

The Systemic Risk Is Real

The threat facing Big Pharma is systemic in nature. The temporal clustering of patent expirations, combined with heavy economic reliance on a few blockbuster drugs, could lead to financial instability and loss of market capitalization. The urgent need to replace expiring products is critical, yet pipelines are not always ready, and average approval times remain high.

Investor and R&D fund interest is also being tested: the biotech sector — often a key source of innovation for pharma — is going through a difficult cycle, with fewer IPOs and more consolidations.

Forced innovation: a New Era for pharmaceuticals

The upcoming patent cliff is more than just an economic threat — it’s a call for change. To face it, the industry must embrace a new approach: more open, more digital, more collaborative.

Those who manage to turn the loss of exclusivity into an opportunity for innovation will maintain a leading position. The others risk being pushed to the margins of a rapidly evolving ecosystem, where efficiency, speed, and clinical evidence will matter more than commercial power alone.