The availability of medicines for human use is increasingly threatened by the phenomenon of shortages — an issue already widely discussed within the scientific community — which can pose a concrete risk to therapeutic continuity as well as to patients’ health and safety.

The causes underlying drug shortages are multiple and interconnected. Among the main factors are the lack of active pharmaceutical ingredients, cost-driven production policies, regulatory issues, or product quality problems (e.g., out of specification). Further complicating the scenario are current international geopolitical dynamics, including the imposition of tariffs, tensions between states, armed conflicts, and related situations of uncertainty and disparities in energy supply, all of which have a major impact on the entire production and logistics chain.

The topic is also inherently delicate when associated with the principles of sustainability, which are becoming increasingly central in the international context, also through the adoption of ESG (Environmental, Social, and Governance) criteria aimed at reducing the impact of human activities and promoting environmental protection, social well-being, and responsible governance.

At AFI (Italian Scientific Society for the Pharmaceutical Industry), a new study group was established to analyze the root causes of drug shortages and identify potential risk mitigation strategies.

The outcomes of this collaborative effort were presented during the latest edition of the Association of Industrial Pharmacists Symposium, held in Rimini in June 2025. The study aims to support companies in developing an informed and systemic vision of the phenomenon, offering insights to promote integrated management of medicine shortages; the topic is relevant not only for the industry but also — and primarily — for patients and regulatory authorities.

The relevance of the topic for authorities is also demonstrated by the most recent regulatory updates, including:

- The work on the “DDL Semplificazioni” for the year 2025 [1], through which an amendment was proposed to the requirement (timelines) of notification to the reference Health Authority “AIFA”, of any potential shortage situation from each Marketing Authorization held by any Marketing Authorization Holder (MAH). The requirement was originally entered into the Italian legislation through the “Calabria Decree” – Law Decree No. 35 of April 30, 2019.

- The revision of Chapter 1 of the Good Manufacturing Practices, which in its consultation version, includes several references to shortage prevention and to the Risk-Based approach that should guide corporate decisions to minimize issues related to the shortage of medicinal products (Eudralex, Vol. 4) [2].

Each company, through structured tools already widely used (e.g. FMEA – Failure Mode and Effects Analysis), can proactively perform an objective assessment to identify the causes that could lead to medicine shortages and prioritize actions to mitigate such risks, where possible.

The study conducted, placed particular attention on the root causes of shortage situations, by adopting a conservative approach that assigns a fixed severity score, assuming the same damage as consequent effect.

The result is a mapping of vulnerabilities and a rationalization of targeted risk mitigation measures. In an increasingly unstable global context, this approach ensures greater operational flexibility, providing a competitive advantage while also ensuring proper awareness of the specific responsibilities toward the healthcare system and patients’ health.

Context and Analysis

Before delving into the topics addressed during the study, it is necessary to clarify the context.

The pharmaceutical supply chain is a system made up of multiple interconnected components. It is a global, highly complex, and strategic system for every country, as it is crucial to ensure the essential levels of supply for patients. Each component — from planning to production, from the procurement of every single material (e.g., raw materials, packaging components, etc.) to the distribution of the finished product — presents challenges that are either inherent to the process itself or arise from the differing priorities set by each company or nation.

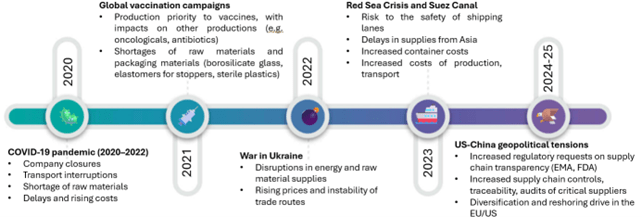

There is no need to look back decades to understand how much pressure the supply chain has faced – and continues to face. Among the most significant cases:

- The COVID-19 pandemic placed tremendous pressure on global production and logistics resources. The 2021 vaccination campaigns shifted industrial attention and priorities toward vaccine manufacturing, causing slowdowns and interruptions in the production of other essential medicines, such as antibiotics and oncology drugs[3]. In addition, serious challenges emerged in sourcing raw materials and packaging components, both of which are critical to ensuring the safety and preservation of vaccines. Moreover, the temporary closure of strategic markets, such as China, highlighted the vulnerability of global supply chains and prompted European countries to revise their production strategies, with the aim of strengthening resilience and reducing dependence on non-EU suppliers.

- In 2022, the war in Ukraine highlighted the vulnerabilities of the supply chain. The conflict disrupted energy and raw material supplies, destabilized trade routes, and led to a sharp increase in production and transportation costs. Geopolitical instability also made it even more difficult to ensure the availability and accessibility of medicines across Europe.

- In 2023, the Red Sea and Suez Canal crisis underscored the strategic importance of securing maritime trade routes[4]; during the crisis, significant delays were recorded in supplies coming from Asia, with a direct impact on the availability of active ingredients and other materials. Furthermore, the increase in container and freight costs worsened the situation.

- In 2025, geopolitical tensions brought new levels of complexity. Regulatory authorities (e.g., EMA, FDA) intensified compliance requirements regarding supply chain transparency, imposing stricter controls on traceability, more rigorous audits of critical suppliers, and tighter reporting obligations. This regulatory pressure led many companies to diversify their sources of supply and to consider reshoring strategies in Europe and the United States[5]. In addition, tariffs and the growing presence of trade barriers further threaten the smooth flow of international commerce and risk increasing the final cost of medicines.

As part of the strategies to prevent drug shortages on the market, the FMEA (Failure Mode and Effects Analysis) methodology was applied to the supply chain, with the aim of systematically identifying potential points of vulnerability. The analysis covered all critical stages of the production and distribution process, allowing each failure mode to be assessed in terms of severity (S), probability of occurrence (P), and detectability (D). By adopting a conservative approach, the severity score was standardized for all types of products to ensure to ensure maximum focus on root cause analysis and the implementation of effective prevention strategies.

The analysis made it possible to distinguish two macro risk categories: global risks, associated with external and systemic factors (e.g., increased tariffs, geopolitical tensions, border closures), beyond the company’s direct control; and local risks, arising from company processes, operational decisions or strategic choices, which are potentially addressable through targeted organizational actions.

Global risks

Global risks

The analysis showed that global causes represent external and systemic factors requiring a coordinated approach among stakeholders. It highlighted the need to promote cooperation through the establishment and maintenance of inter-company working groups and open communication channels with the competent Authorities. These tools support an efficient and timely response in critical situations, for example through a joint approach to the protection of critical medicines, the simplification of regulatory processes, and the coordinated management of patents.

Local risks

The so-called “local” criticalities, on the other hand, are attributable to internal company factors such as processes, strategies, and operational decisions. The analysis made it possible to identify and prioritize these risks, allowing for the definition of targeted corrective and preventive actions.

Procurement processes are particularly affected by two major challenges: a high reliance on non-EU suppliers and the increasing complexity of global supply chains. Pharmaceutical companies have already identified mitigation tools to address risks arising from these aspects. Although companies have, for several years, implemented supplier qualification systems (including periodic risk-based supplier reviews and audits), these criticalities continue to persist. The analysis highlighted the importance of diversifying sources of supply and establishing synergistic relationships between suppliers, manufacturers, and distributors, based on clear and timely communication. Proposed actions include shortening the supply chain, integrating alternative suppliers within structured business continuity plans, and managing critical stocks in an integrated way. Furthermore, technical agreements (Quality Agreements) could include supply continuity as a key element for monitoring the quality management system.

Logistical issues are a significant contributor to drug shortages, especially when cold chain requirements—critical for the integrity of many pharmaceutical products—are not met. Non-compliance may result from inappropriate transport vehicles or insufficient traceability and documentation of storage conditions throughout the supply chain. The rationalization of these issues has made it possible to identify several countermeasures, already known but often applied inconsistently within a complex logistical framework. Transport validation, the selection of qualified carriers, the implementation of maintenance and calibration plans for vehicles, and continuous distribution monitoring are all measures already known in the sector but that can be strengthened through new strategic approaches, including the diversification of logistical sources and the reinforcement of national and international coordination between companies, regulatory bodies, and industry operators.

Within the Regulatory and Quality Assurance framework, the root causes of drug shortages can be traced to various factors: non-compliance of raw materials or APIs (Active Pharmaceutical Ingredients), out-of-specification (OOS) results on the finished product, insufficient or non-harmonized controls among different supply chain actors, and slow authorization processes, often exacerbated by patent expirations. A notable example occurred in 2018, when nitrosamine impurities were detected in several active ingredients, leading regulatory authorities to require further investigations and the consequent suspension of the CEP (Certificate of Suitability) of the involved manufacturing companies[6].

The consequences of such events were significant: in addition to delays and shortages, product recalls, and unavailability for patients, there was an increase in regulatory requirements worldwide.

Beyond the adoption of effective qualification and continuous supplier monitoring methods (targeted audits, supplier development, etc.), the analysis highlights the need to ensure diversification of supply sources, where possible, to avoid dependence on a single manufacturer. Strategy and proactivity are key aspects for accurate risk and crisis management. The existence of a pre-agreed alternative plan represents a clear competitive advantage.

Manufacturing-related drug shortages frequently stem from structural and organizational inefficiencies that have a direct impact on production processes. Among the most critical issues are outdated plants that must compete with global players capable of building facilities rapidly, delays in implementing corrective plans, and a concentration of production on high-margin drugs, which may penalize the availability of essential but less profitable medicines. Companies must therefore adopt strategic (planned shutdowns for maintenance, technological upgrades) and operational measures (creation of strategic stockpiles) to ensure production continuity under any circumstances.

Conclusions

The pharmaceutical sector, today more than ever, is facing with complex challenges and unpredictable situations. However in consideration to the results of this work, it is clear that, each company, through the awareness of vulnerabilities, as starting point, can build its future with resilience and competitiveness.

If risk management is approached proactively and in a structured manner, it not only allows for the reduction of unforeseen disruptions and improved productivity, but also strengthens the trust of customers and partners, ensuring prompt and transparent responses to authorities regarding the decisions taken. Moreover, understanding risks and implementing effective mitigation measures can constitute a competitive advantage, enabling companies to adapt quickly to changes in their environment.

The proposed path — consisting of analysis, measurement, identification of appropriate actions, and monitoring of their effectiveness — is a concrete call to action, guided by method and vision. In a context where uncertainty has become the “new normal”, the true competitive advantage lies in preparedness. The path outlined here is not merely a best practice: it is a strategy designed to transform vulnerability into awareness and awareness into action. Because today, it is no longer enough to be ready to react — it is essential to be able to lead change.

—

Autors:

Ana Ambrona, Jazz Healthcare Italy S.r.l.

Andrea Mezzelani, Zentiva Italia S.r.l.

Denise Mori, GIF Associate

Donato Migliarino, Farmaceutici Formenti S.p.A. (Grünenthal Group)

Ivan Belloni, Valpharma International S.p.A.

Rita Brusa, AFI

Silvia Sanzone, Industria Farmaceutica Galenica Senese

Tania Perfetti, Ingenus Pharmaceuticals GmbH

References:

[1] Senate Act. 1184 – XIX Legislature (Simplification of economic activities year 2025 approved on October 08, 2025

[2] https://health.ec.europa.eu/consultations/stakeholders-consultation-eudralex-volume-4-good-manufacturing-practice-guidelines-chapter-1_en

[3] Socal, M. P., et al. (2021). Gaps in Pharmaceutical Production and Distribution. PMC – National Institutes of Health.

[4] International Transport Forum – OECD. The Red Sea Crisis: Impacts on Global Shipping. Marzo 2024

[5] EMA, “Good Practices for Industry: Prevention of Human Medicinal Product Shortages” (2023)

[6] Regulation of Nitrosamine Impurities in Pharmaceutical (GMP-Platform) – 2024/09/24