M&A, which stands for ‘mergers and acquisitions’, is a set of merger and acquisition transactions between companies and represents a possible corporate growth strategy through the acquisition of new technologies, market expansion and cost reduction.

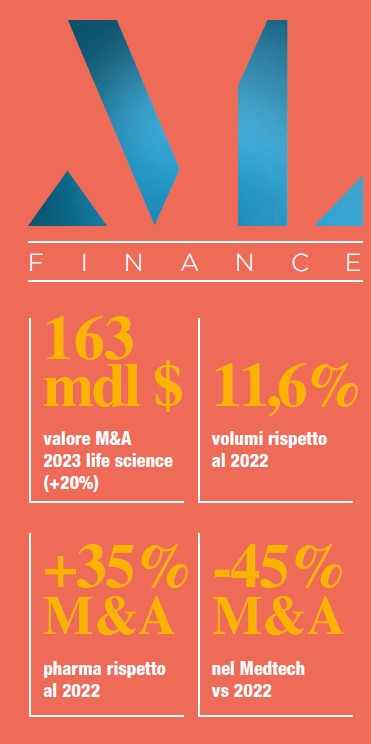

Accordly to Deloitte’s report analysing M&A trends in 2023, the ‘Life Sciences’ sector, led by the pharmaceutical segment, is trending above expectations, both in terms of value and deal volume, with deals worth $163bn significantly exceeding the $135bn in 2022 (+20%).

Oncology represents the therapeutic area in which most of the value of deals in 2023 was recorded, although their total volume decreased and is on a par with deals between companies in the ‘central nervous system’ and ‘endocrine’ and ‘metabolic’ areas. Prospectively, oncology is expected to continue to be a strong driver for M&A activity in 2024, supported in particular by market interest in antibody-conjugated drugs (ADCs), bispecific antibodies and CAR-Ts. In addition, the first approval in 2023 of therapies based on the Crispr-Cas9 genome editing technique (Casgevy; exagamglogene autotemcel for patients with sickle cell anaemia or beta-thalassaemia) should also provide a strong impetus for cell and gene therapies in the years to come, particularly for M&A activities in the field of rare diseases.

2024, good but not great

The outlook for 2024 is mixed. As far as the pharmaceutical sector is concerned, during 2023 many giants announced cost cuts and divestments with the sale of assets to smaller companies and the retention of minority stakes, as well as the sale of pipeline assets to other large pharmaceutical companies. This trend is expected to continue in 2024, when several drugs in various therapeutics are about to lose exclusivity.

However, this very situation should be favourable for a reinvestment of the capital freed up by corporate reorganisations in acquisition transactions to fill portfolio gaps caused by products with expiring protection.

It is difficult, however, to still witness the mega-financial transactions that took place a few years ago. The current trend in pharma seems to favour more specific – and less financially demanding – open innovation actions.

What impact will GLP-1 have?

In terms of therapeutic area, Deloitte focuses mainly on the market dynamics related to the treatment of obesity.

The rise of GLP-1 analogue drugs in the treatment of obesity has generated significant growth opportunities in the pharmaceutical sector for companies involved in their production at all stages of drug development. At the same time, however, the clinical efficacy of GLP-1s on obesity and associated diseases has raised concerns among pharmaceutical and medtech companies already offering therapeutic solutions, which now see themselves threatened by this new class of drugs.

According to the report’s predictions, on the one hand, these pharma companies will explore more high-end obesity therapeutic options or move towards complementary activities, shifting their focus to therapeutic areas considered ‘GLP-1-resistant’, such as rare diseases, neurology and oncology. At the same time, MedTech companies are expected to investigate opportunities that are not influenced by GLP-1s or areas where the extension of human life may result in an increased demand for treatments.

Given the impact artificial intelligence is having on all sectors of the economy, it is easy to predic

Our customers have expressed an interest in this sector and in the third and fourth quarters they have signed various partnerships for the development of AI-based pharmaceuticals.

Deloitte report

MedTech companies, promise of the year

In 2023, the MedTech and diagnostic business declined in both mergers and acquisitions. Indeed, companies focused their attention on divestments and transformations rather than on finding new avenues for expansion.

As a result, the total value of deals fell by almost 45% year-on-year to USD 13.5 billion (although their volume actually increased). However, it seems that it is precisely the MedTech sector that will enjoy the best prospects for the current year thanks to the boost offered by the general expansion of technology and in particular the boost imparted by the development of artificial intelligence. Indeed, significant growth is forecasted for this sector after a period of slowdown in 2022 and 2023.

2023 will therefore not be considered an exceptional year for mergers and acquisitions in the life sciences sector, but overall transaction values and activity have been resilient despite several unfavourable macroeconomic factors. According to Deloitte’s experts, thanks to the potential rebound of the MedTech sector, the M&A environment for 2024 is expected to be favourable and up from last year.